Market Report for Jan 23, 2020

Market Report Gold Silver Bitcoin Nasdaq Dow Jones S&P500It’s Saturday, January 23, 2021, and this your Gold, Silver, Bitcoin, and Stock Market report. What a week! Stock market indices close near all time highs, Bitcoin got clobbered earlier in the week, and Gold and Silver market rebound slightly.

Stock markets rallied last week, buoyed by the incoming Biden Administration and its shift to taking the Covid19 pandemic seriously. Gold and Silver had price gains but the charts continue to show a slow slide to the downside. Bitcoin sold off in the week amid comments made by incoming Sectary of the Treasury Janet Yellen on limiting the use of Bitcoin.

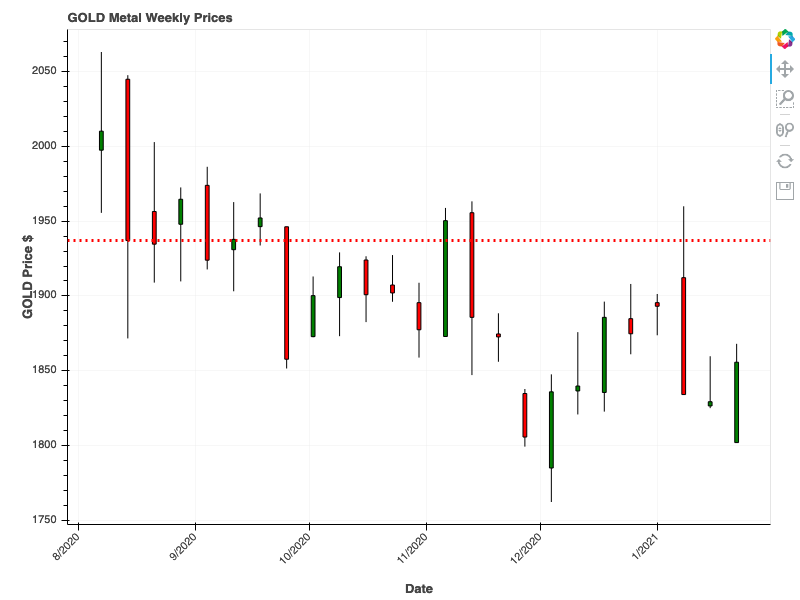

Gold Chart

Gold had a good week, closing higher from the week before. It closed +1.44% higher to close at $1,855.69 from $1,829.30 the week before. The chart continues to show downward price pressures on Gold. It continues to make lower-highs and lower-lowers. The good news is that our models show Gold closing higher for next week.

We expect Gold prices to drift lower as uncertainty and the Trump volatility exits the financial system. We have no long term price targets for Gold at this time.

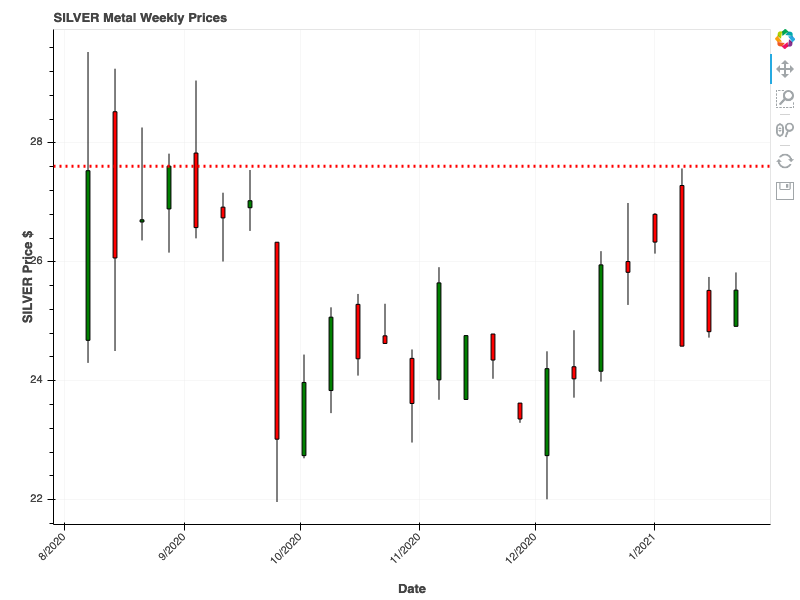

Silver Chart

Silver had a good week, it closed higher to $25.52 from $24.82 the week before for a +2.81% increase. Just like with Gold, we expect Silver prices to drift lower over the coming weeks. Silver is struggling to take out resistance at $27.61 and is overshadowed by the violent sell-off (bearish candle) from two weeks ago. Our models point to a higher close for Silver next week.

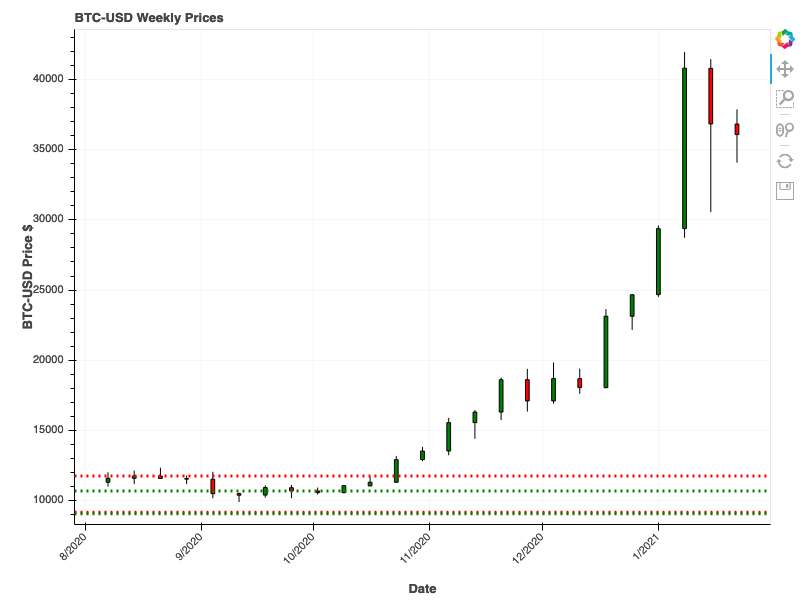

BTC to USD Chart

It is not uncommon for Bitcoin to have a volatile week and this week was no different, however, this week it was about one very BIG bit of news. Incoming Secretary of the Treasury, Janet Yellen, had this to say about Bitcoin:

“One area of growing concern, for example, is the potential for terrorists and criminals to use cryptocurrency to finance their activities.” - via Bitcoin.com

This comment comes at the heals of new information that Bitcoin was used to finance the attempted coup on the US Government by Trump supporters and nefarious actors.

Bitcoin closed down -2.05% to $33,025.98 from $36,069.80 the week before. Our models point to a higher close for Bitcoin next week.

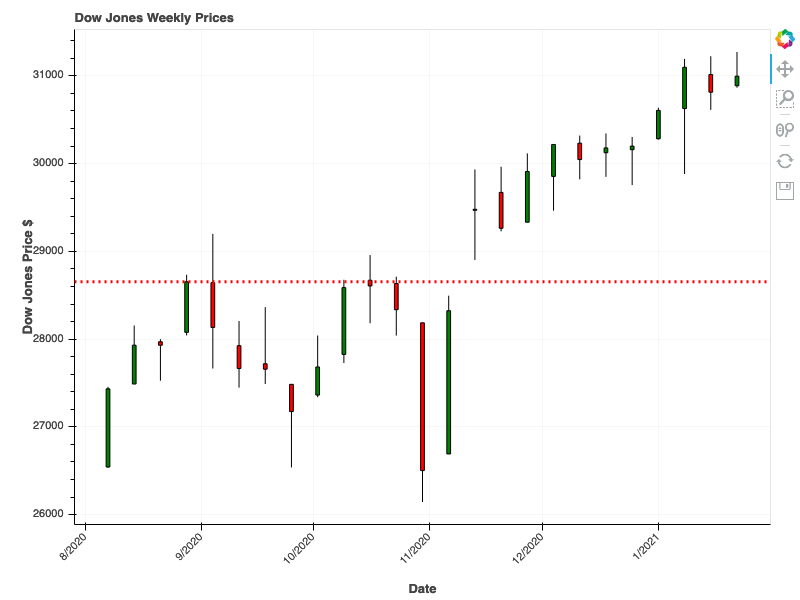

Dow Jones Chart

The Dow Jones made an intra-week all-time high as the markets welcomed the Biden administration and anticipated more stimulus over the coming weeks. The Dow Jones closed to 30,996.98 this week up from 30,814.25 last week for a +0.59% change. Our models point to a higher close for the Dow next week as money on the sidelines starts to rotate in. Hold on to your seats everyone!

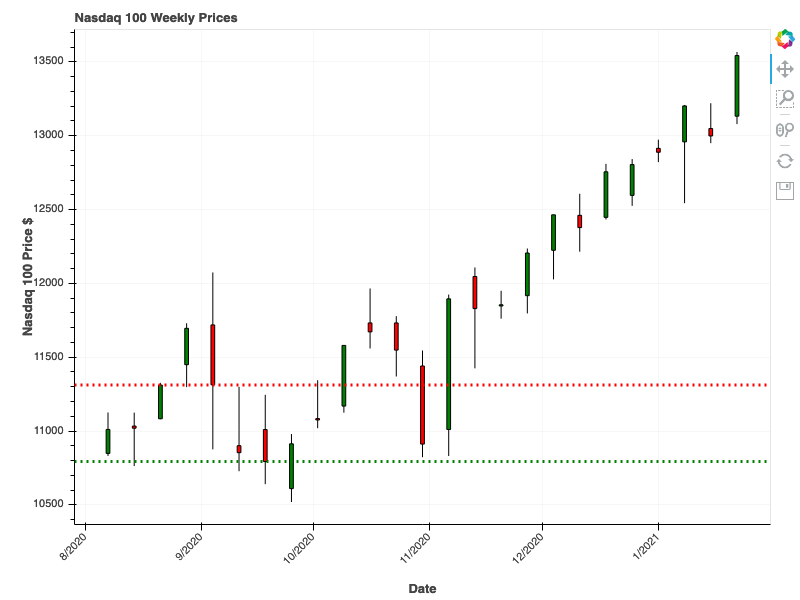

Nasdaq Chart

The Nasdaq closed at a record last week. It continues to move higher as investors and speculators believe that technology will help us come out of this pandemic. As they say on r/WSB, Stonks go up!

The Nasdaq 100 closed this week to 13543.05, up from last week’s close of 12998.5 for a +4.18% gain. Our models point to a slightly higher close for the index as tech stocks catch their breath.

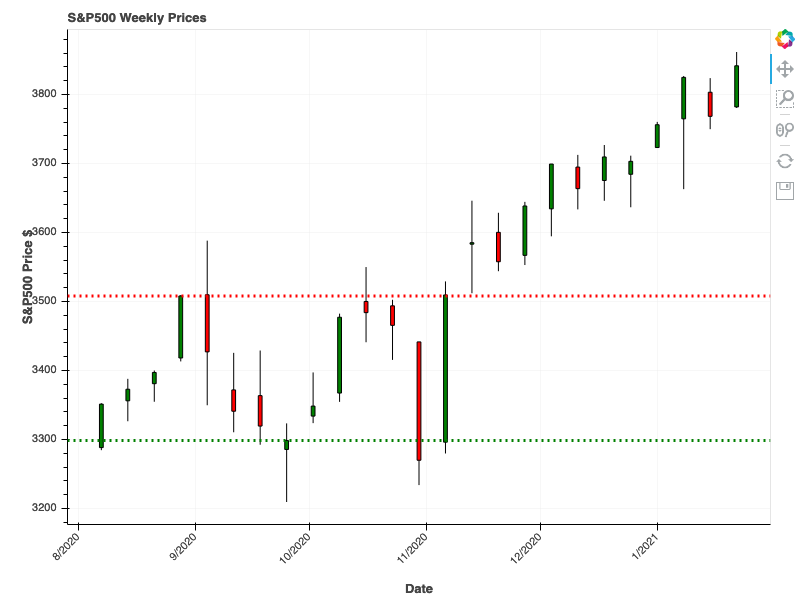

S&P500 Chart

This week the S&P500 closed to a new all-time high. The stock markets are ‘Riding with Biden’ as the Trump volatility ebbs. The S&P500 closed to 3841.46 this week, up from 3768.25 last week for a +1.94% gain. Our models point to an even higher close for the index next week.

At some point, the euphoria will wear off as stocks look toward the upcoming earnings season. We remain cautiously optimistic but expect a prolonged consolidation phase sometime in the future.