Market Report for Jan 30, 2020

Market Report Gold Silver Bitcoin Nasdaq Dow Jones S&P500It’s Saturday, January 30, 2021, and this your Market report. What a crazy week! Stocks had an up and down week, Metals were mixed, and Bitcoin is acting like a rabid lemming looking for a rocket or a cliff.

Let’s start with…

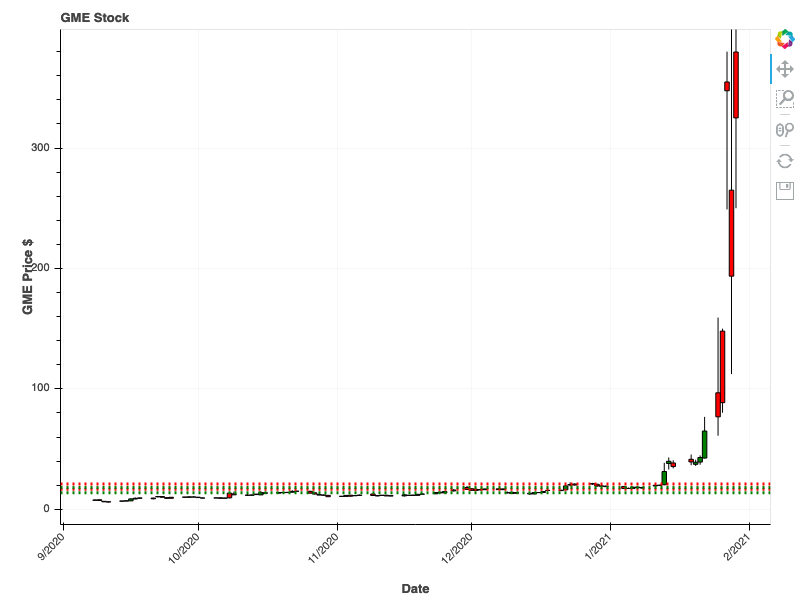

Gamestop. This week the WallStreetBets Reddit group (r/WSB) came out in force to crush Melvin Capital, a hedge fund that had heavily shorted GME shares. The r/WSB folks decided that this was wrong and created a short squeeze on Melvin’s position. This caused ALL kinds of insane price moves, which I wrote about in my “Short Squeezing Gamestop (GME)” Medium post.

Only time will tell if the Meme Stock Market is here…

The GME chart is parabolic right now with price spikes over $380 per share in regular market hours They crossed over $500 per share in pre-market trading. Chatter on the r/WSB group wants to push GME to over $1,000 a share.

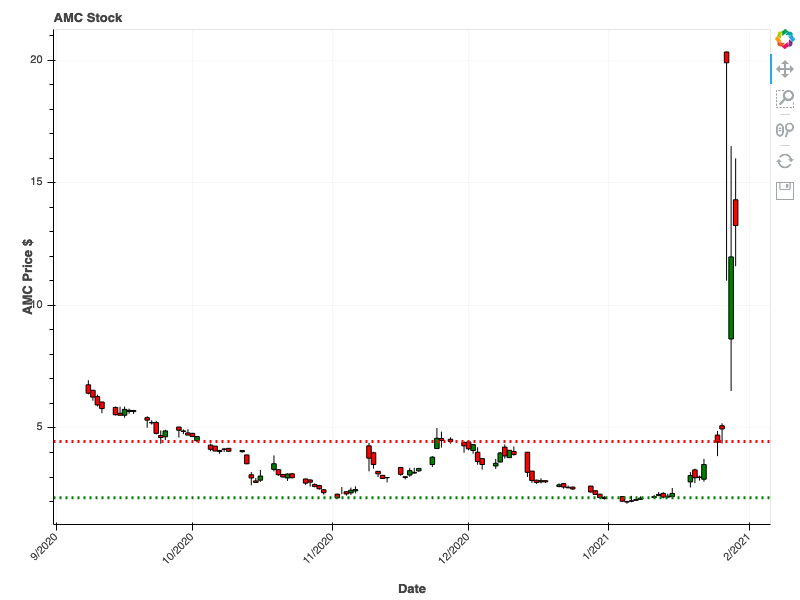

AMC is another darling from the r/WSB group is pushing to crush short sellers. The news broke on Thursday morning (1/28/21) that AMC is converting its convertible notes to common stock. This pushed the prices down from the highs and create a nice hanging man chart pattern. A very ominous pattern.

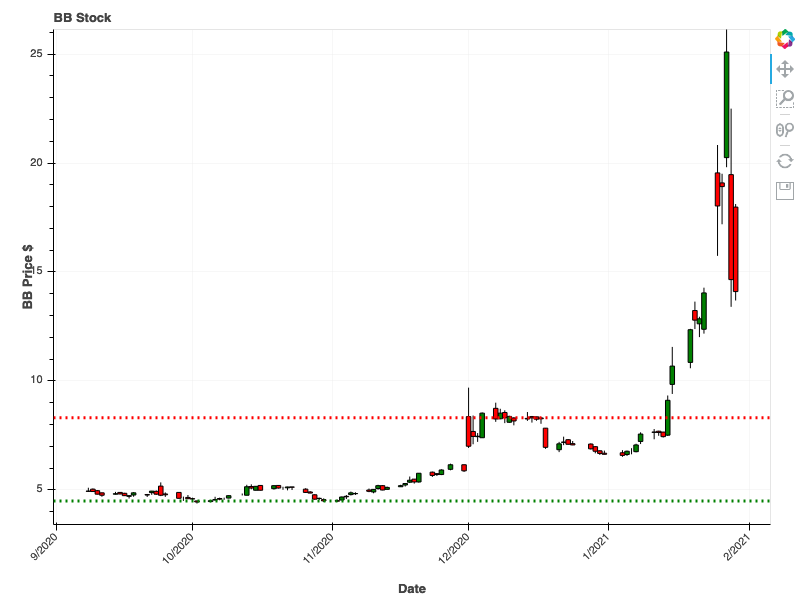

Another openly pumped stock is Blackberry. Remember them? They’re still around for some strange reason and had a bit of positive news. The r/WSB group is thinking this old company will go to the moon!

Right now it looks like it shot up to the moon only to come down. The chatter on the boards wants to push AMC to the moon and I expect lots of volatility in all three of the stocks next week.

Meme Stock Market

Only time will tell if the Meme Stock Market is here to stay or everyone forgets to take their ADHD medicine and gets bored of the stock market.

What about the stock market? It had a down week. Profit taking, problems at Robinhood, and general unwinding of shorts cause a lot of market volatility to the downside. I’m not saying the GME was the main cause of it but that kind of volatility can spread to a lot of different market sectors fast.

The Metals, in general had a mixed week with Gold closing lower and Silver testing the important $27 an ounce level! Our favorite cryptocurrency, Bitcoin, had the usual volatile week rising and falling in price like the tides.

With all the volatility in the markets and meme’s disrupting well established hedge funds I’m going to say that a new and silly Roaring 20’s is here.

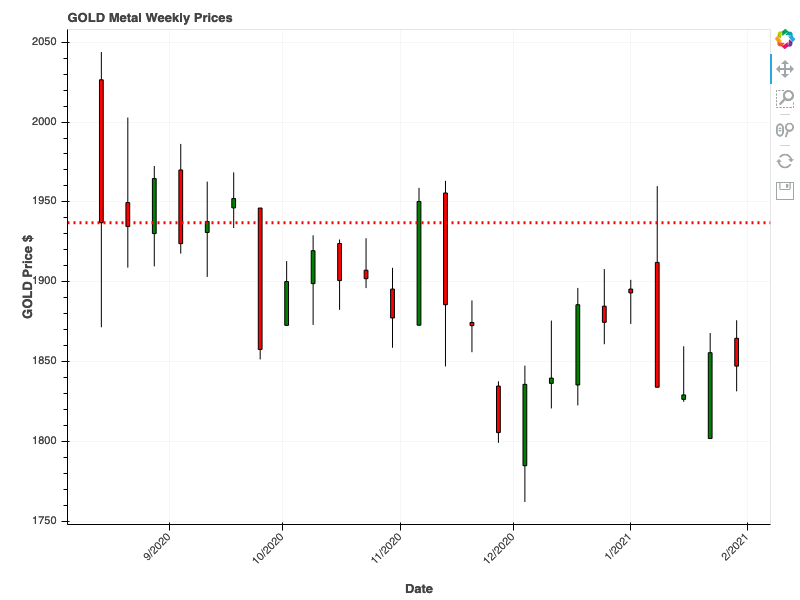

Gold Chart

Gold closed lower for the week, down -0.45% to $1847.30 from $1,855.69 the week before. Continued trends have Gold drifting lower and our property models point to Gold lower close next week.

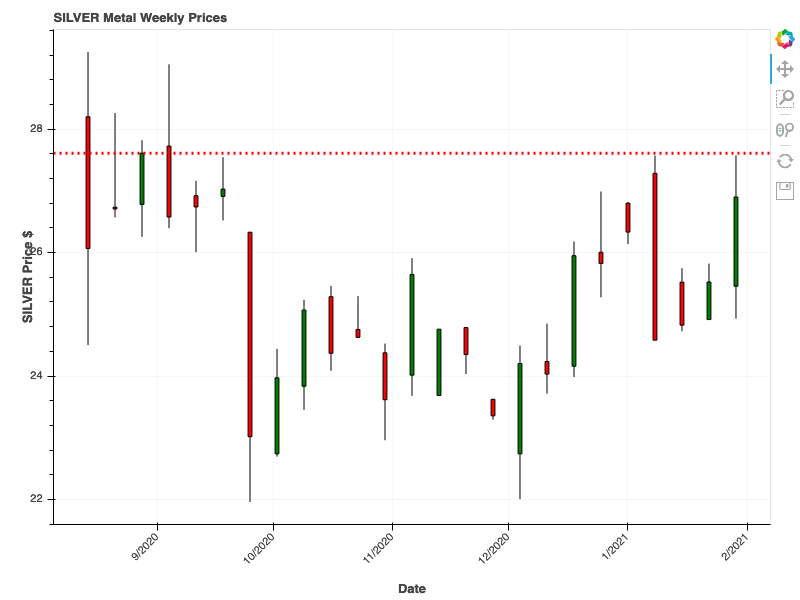

Silver Chart

Silver had a good week, it closed higher to $26.90 from $25.52 the week before for a +5.39% increase! Just like with Gold, we expect Silver prices to drift lower over the coming weeks. Both the $27 and resistance level at $27.61 are key areas for Silver to cross if it wants to move higher in the short term.

We feel that Silver will fail to break out and our models point to a lower close for Silver next week.

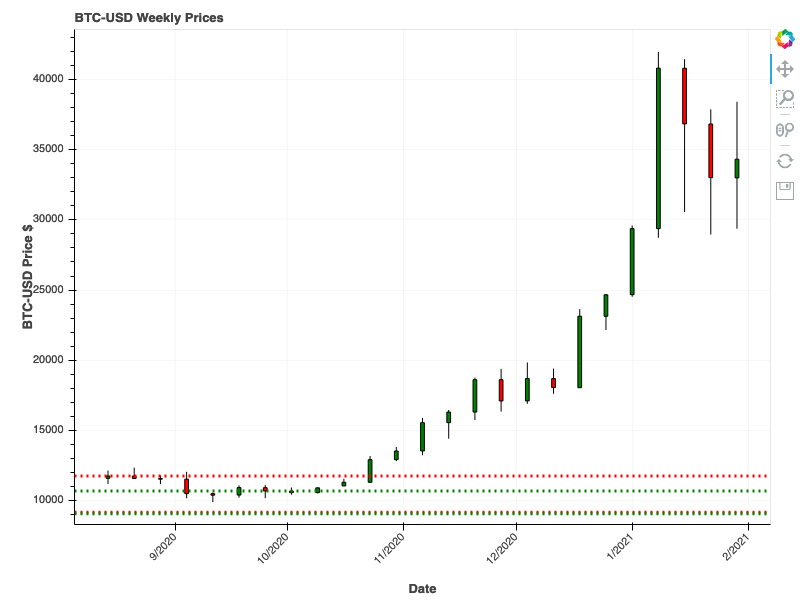

BTCUSD Chart

Another crazy week for Bitcoin, it traded all over the place this week. Bitcoin closed up +3.97% to $34,316.38 from $33,025.98 the week before. Our models point to a higher close for Bitcoin next week.

BTCUSD is a crazy market that I won’t trade but I do make small purchases just in case it becomes something real! If you want a piece of the cryptocurrency action, you can try Coinbase (affiliate link). I use them for all my BTCUSD purchases.

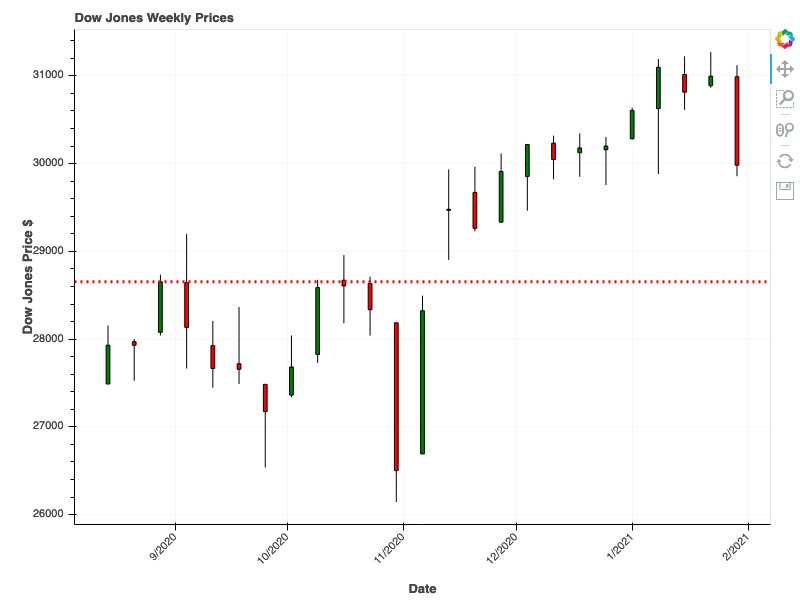

Dow Jones Chart

The Dow Jones pulled back from highs to close down the most this week in a long time. The Dow Jones closed to 29,982.61 from last week for a -3.27% change. We believe that these pull backs present buying opportunities for the long term as money from the sidelines starts to pour in. Our models point to a higher close for the Dow next week.

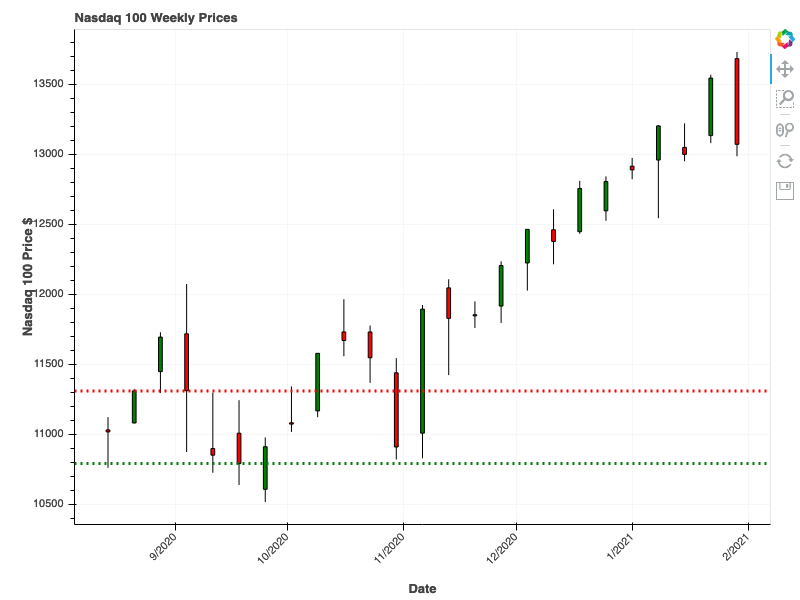

Nasdaq Chart

Just like the DOW, the Nasdaq 100 closed this week lower -3.48% to 13,070.69 from 13,543.05 the week before. Our models point to a higher close for the index as tech stocks catch their breath here.

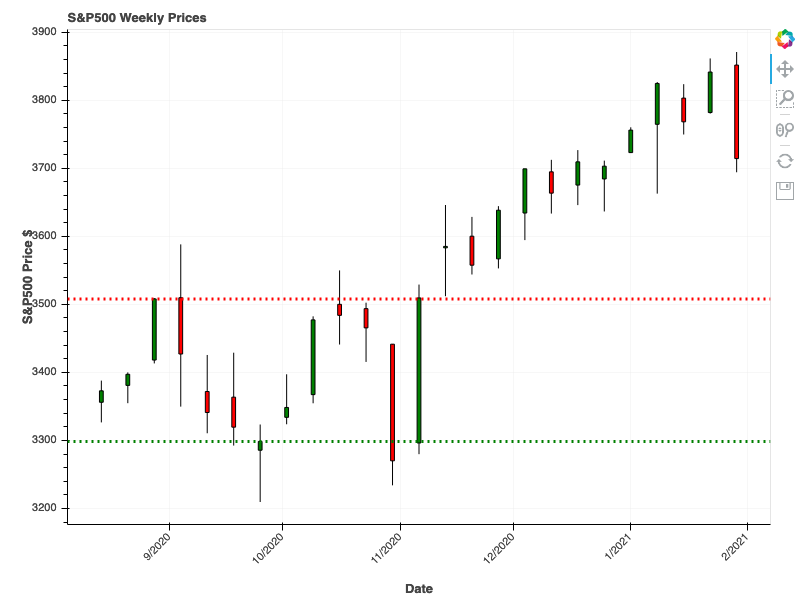

S&P500 Chart

Last, but not least, the S&P500 fell in line with the selloffs across the broader market. The S&P500 closed down -3.31% to 3,714.23 from 3,841.46 this week. Our models point to an even higher close for the index next week.