Is the market in good shape? Will it go higher from here? Or will it crash? There’s a lot of chatter out there right now and no one knows what’s going to happen in the markets. NVDA is breaking out and moving higher but BA is selling off like crazy. Talking heads think the Fed has engineered a soft landing for Wall Street but Main Street isn’t feeling so good.

Traders and investors are nervous about this all going “tits up” but are more scared of missing out. On top of that, it’s an election year and Trump wants to market to crash under Biden. Meanwhile, Biden has been canceling student debt and exporting more oil than ever.

It’s the best of times and the worst of times happening in front of our eyes.

What can we do? Just watch the indicators and plan accordingly.

My recession indicator

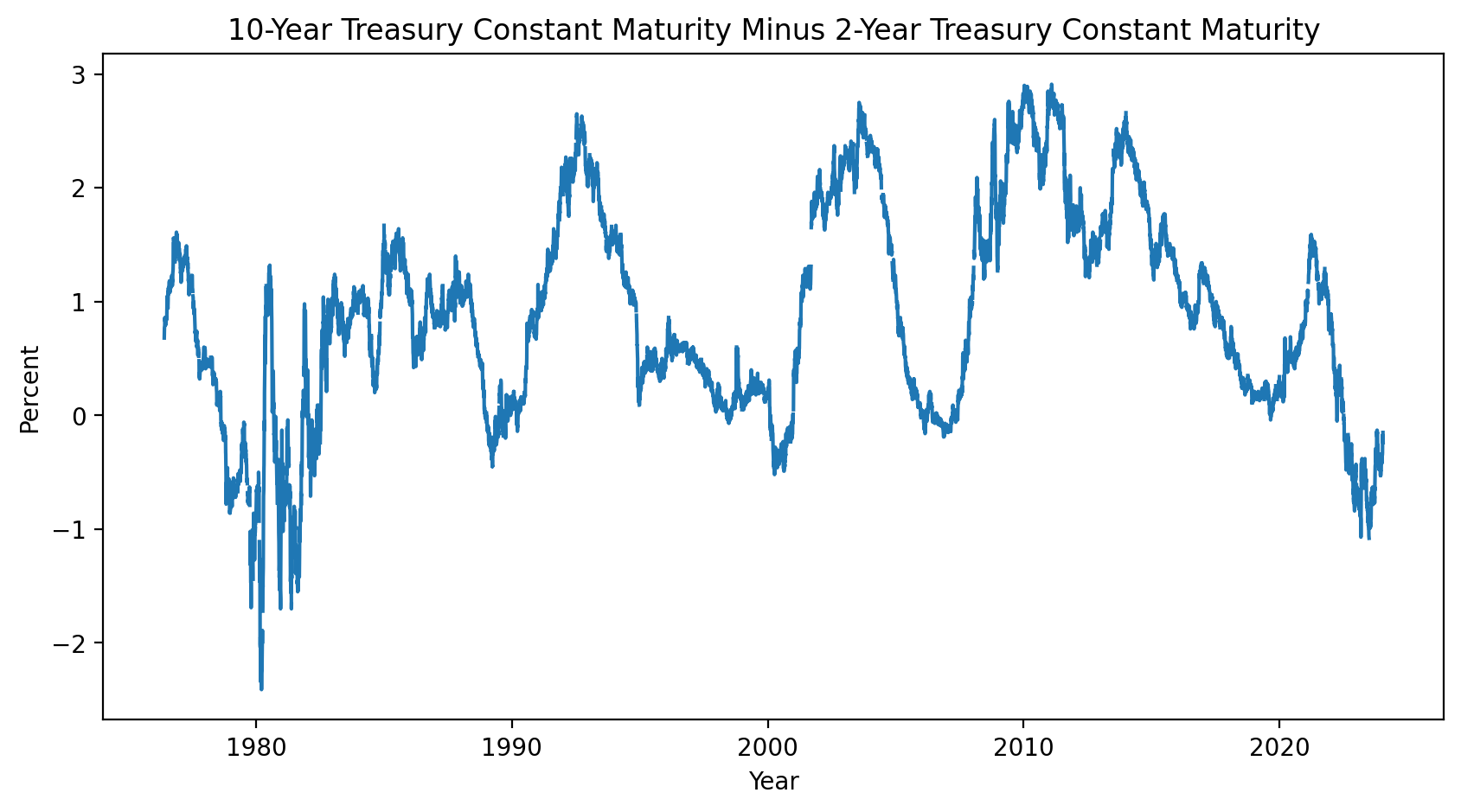

My favorite recession indicator is the 10-year and 2-year Treasury bill spread. When it’s negative (and it’s -0.24 right now) it means the yields are inverted. This has always been an indicator that a recession is coming.

Looking at this chart you can see that it’s been negative for a long time but trending back to 0. I guess that two things are happening here and are true at the same time. One, you don’t fight the Fed and two, the debt market doesn’t believe the Fed.

I’m not convinced 100% that we’ll avoid a recession but I’m just a guy with a blog, what do I know?

Mortgage rates and housing starts

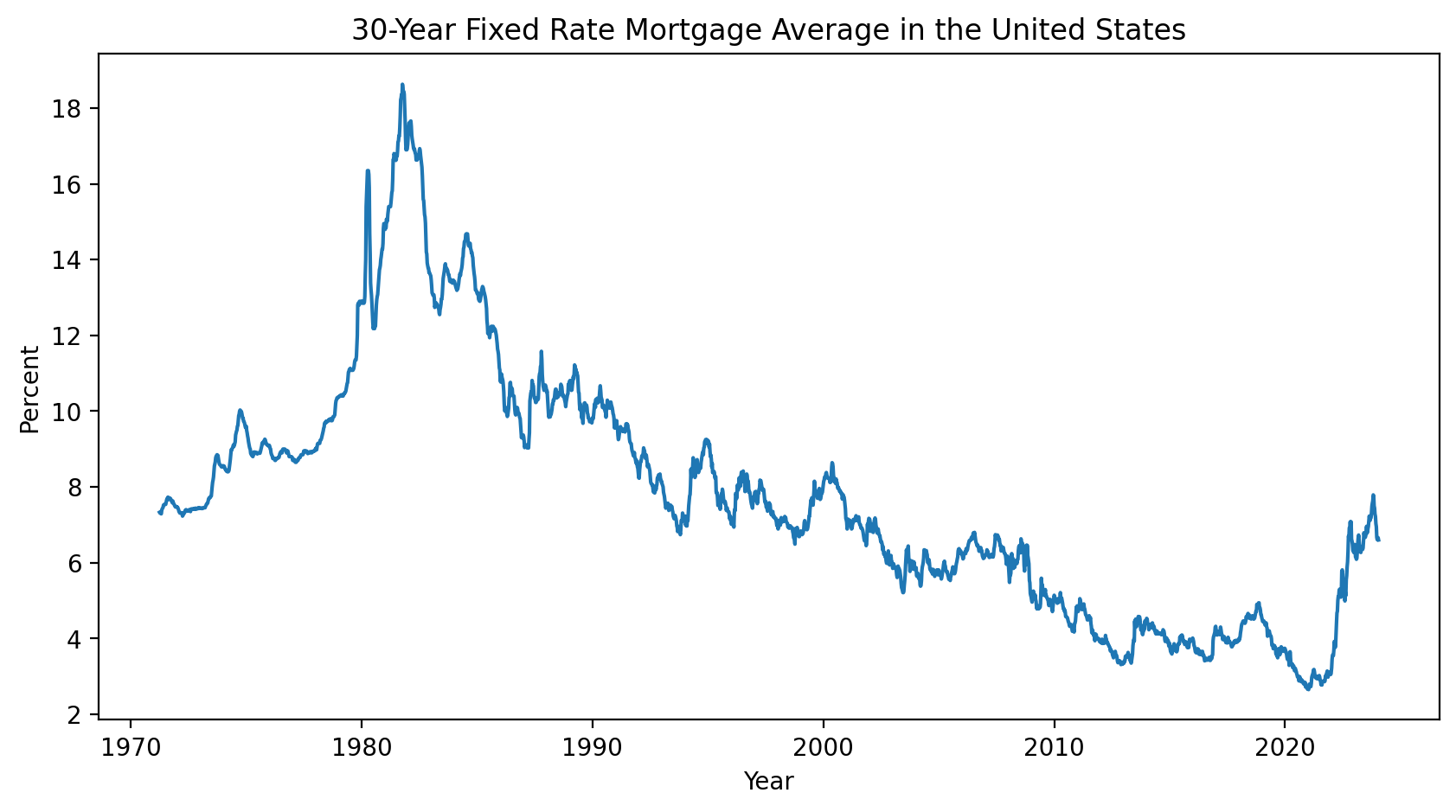

Mortgage rates have been through the roof lately but historically they’re pretty low. They’re killing all the fly-by-night real estate investors. Gone are the days of buying property at high valuations and selling it for even higher valuations.

The real estate investors that bought last are the ones holding the bag right now and they’re feeling a lot of pain. Still, a rate of 6.60% for a 30-year fixed mortgage is pretty good and this drop from 7.79% in October of 2023 is bringing some relief to real estate investors. It’s also opening up the demand again but the risk remains that you’re buying property that’s too damn expensive.

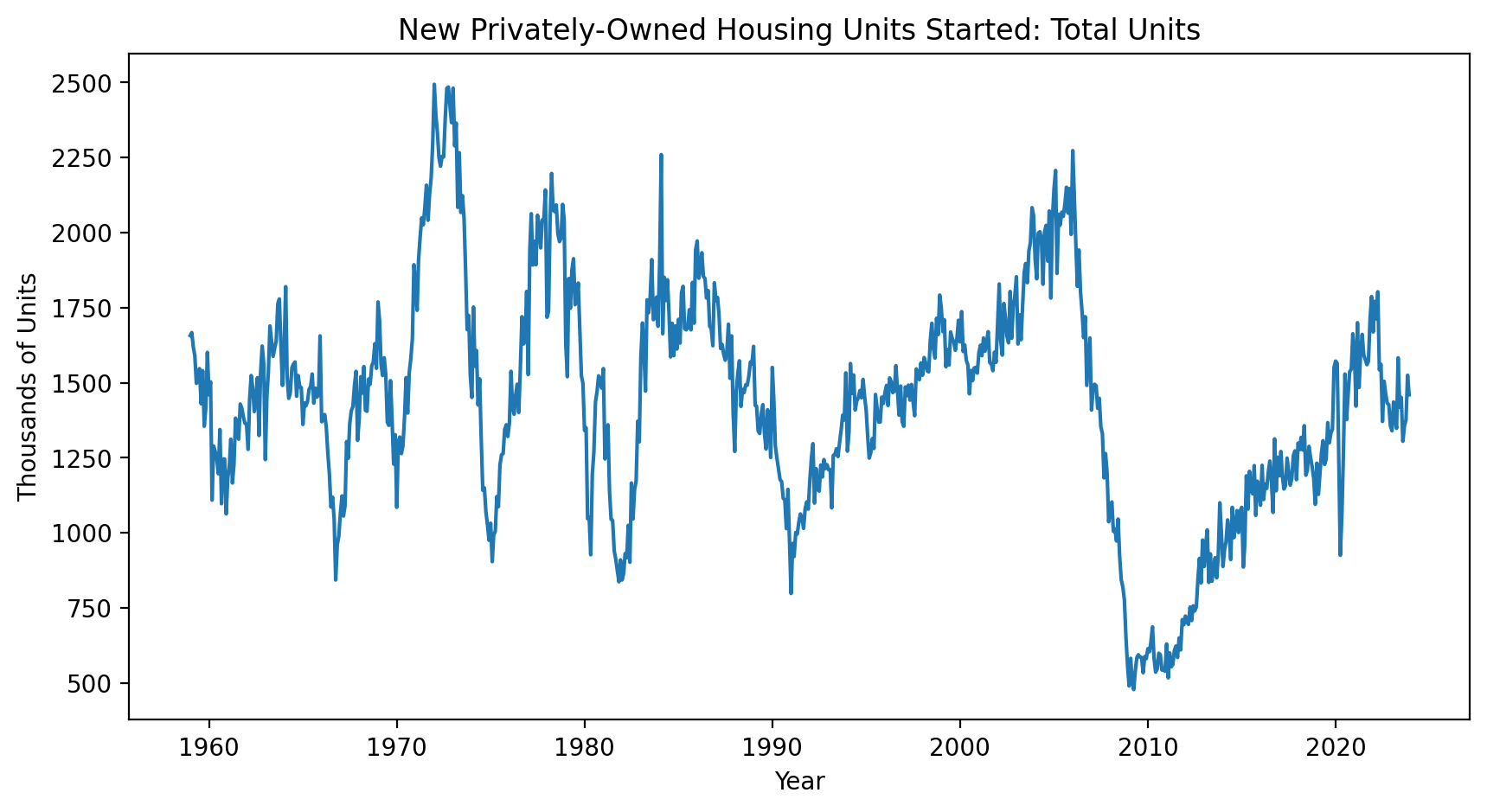

What about housing starts? Weren’t the builders going to save our lives here? Yes and no, there was a local rebound but looking at this graph it sure looked like a higher low than a higher high. The trend remains down for housing starts.

Yet the market is doing well and it’s riding high. So what gives with all these conflicting signals. I think it’s starting to smell like a sucker’s rally. That includes last year’s Santa Rally. How far will this sucker’s rally go? Biden’s hoping it will last until a day after the election. Trump wants it to crash now.

The only thing I know is that I don’t know what the market will do. I do know that one day it will crash, again. Just like I know that it will recover and go higher, again. The trick is to be prepared and not get slammed.

Learn Stock Trading, Investing, and Risk Management

There are a handful of financial and trading books that have made a HUGE impact on my investments. If you want to trade and learn about money and risk management then I suggest you get the Van Tharp book. If you want just focus on long term investing, get the Random Walk Down Wall Street book.

Hell, get them both. I owe my wealth to what I learned in those books.