Made In Japan - EWJ iShares ETF

Back in 2007, I wrote this in a post about the iShares MSCI Japan ETF:

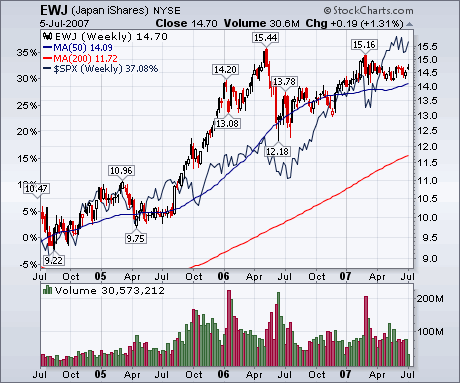

I decided to take a closer look at iShares MSCI Japan Index (EWJ) ETF today because of the "carry trade" issue. Investors of the past three years made a good return investing in EWJ. That's probably due to the carry trade firing up the Japanese export machine. This is good news for the Japanese people as they start to claw their way back from a decade long recession.

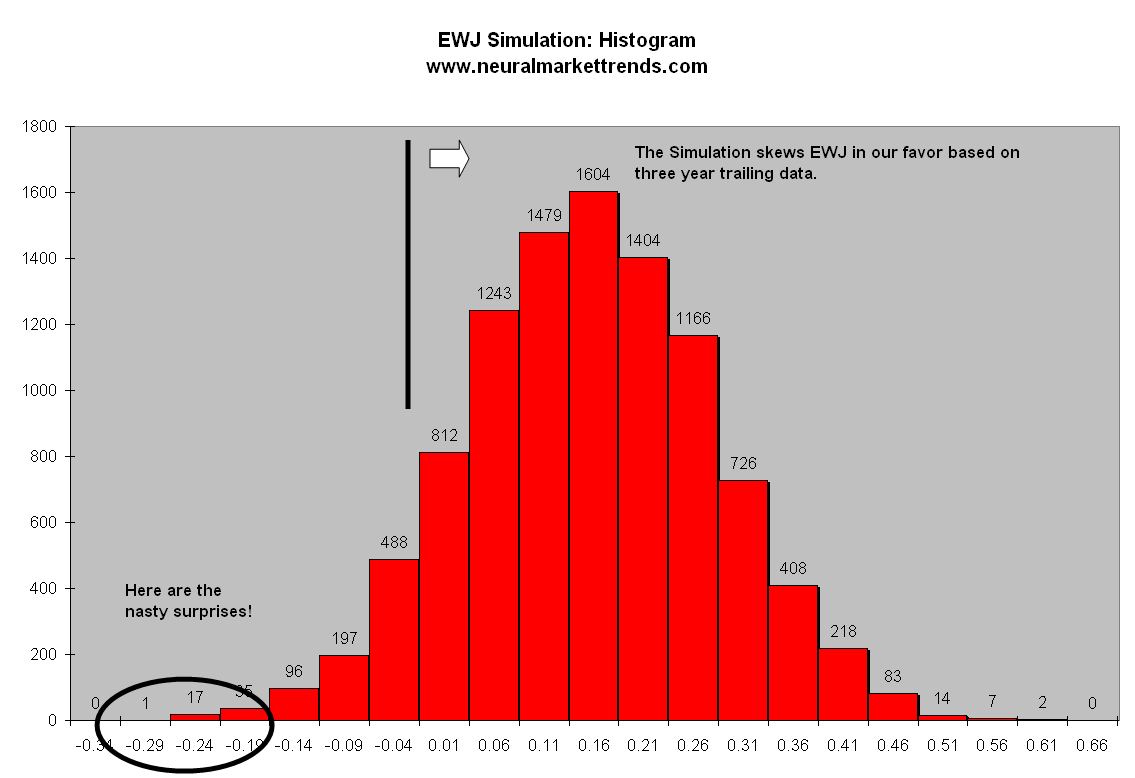

My long term outlook for the EWJ is a bit negative though, even if the odds are in our favor from the Monte Carlo Simulation. The Yen will likely appreciate over time as the BOJ raises rates. This will ultimately slow down the export machine and cause EWJ to take a hit. When this will happen is anyone's guess but based on my experience we'll know when the carry trade unwinds in a hurry!

What would Soros do? He'd probably be short the USDJPY pair right now, I know I would if I had the capital to stick it out.

And I posted these two charts from July 2007:

I don't remember why I was looking at EWJ at the time, probably because it was going up (much like tech stocks have been) and I wanted to make money.

EWJ Today in 2024

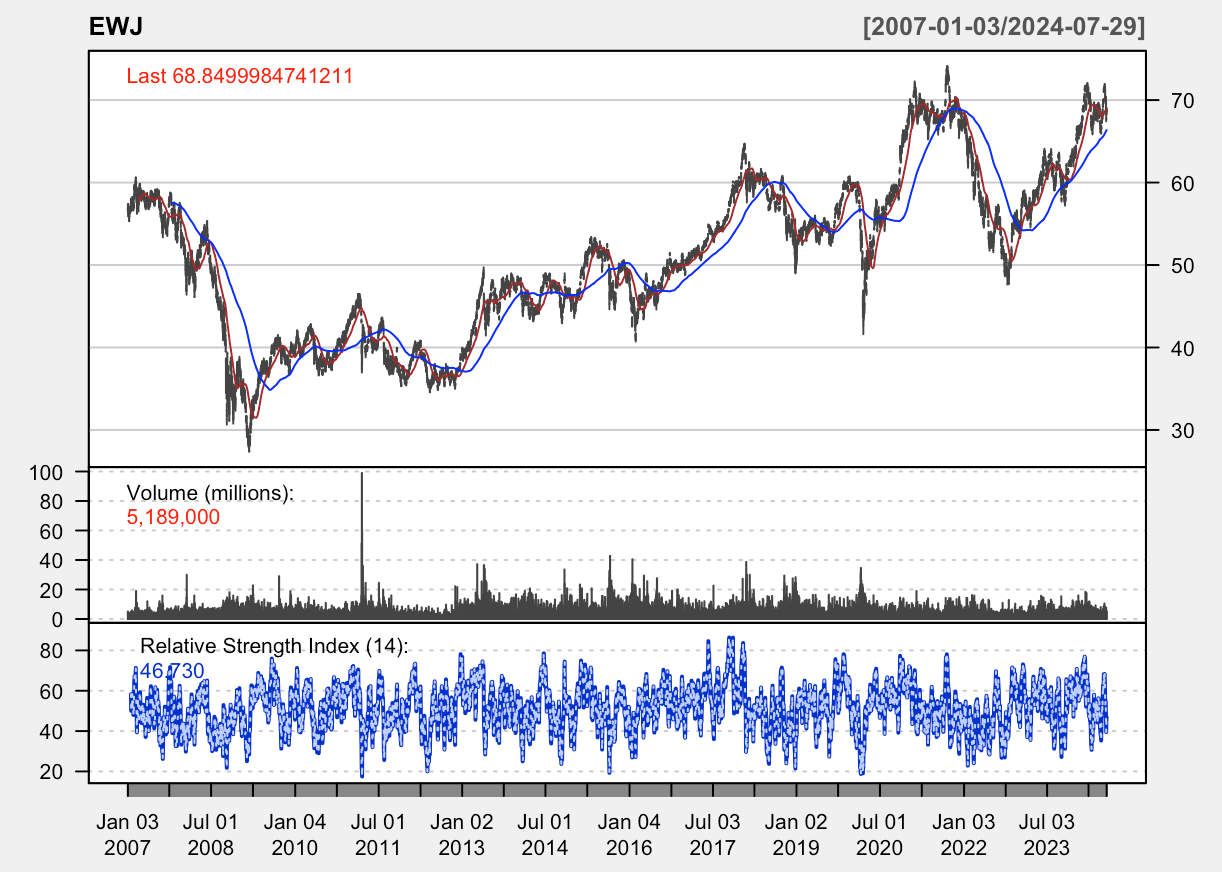

When I first wrote about EWJ in July 2007 - 17 years ago - it sold off quickly and cratered in late 2008. You'll note that the prices are different on the current long-term chart (below) and what was originally posted (above) in 2007.

My guess the iShares did something to this ETF but I couldn't be arsed to go look for it. Here's a zoom-in of the last 12 months of EWJ.

EWJ made an all-time high sometime in March 2024. Since my strategy is not to buy all-time highs for sector and county ETFs, I might've gotten interested in buying in 2008 - but I didn't have any money because I pretty much blew up.

Right now EWJ looks like it made a double top, and that's a Bearish sign. I would consider buying some for my long-term holdings if, and only if, it sold off and the RSI drops to the 30 level. I like to buy things way oversold if I could for long-term holdings.

Member discussion