Market in Review

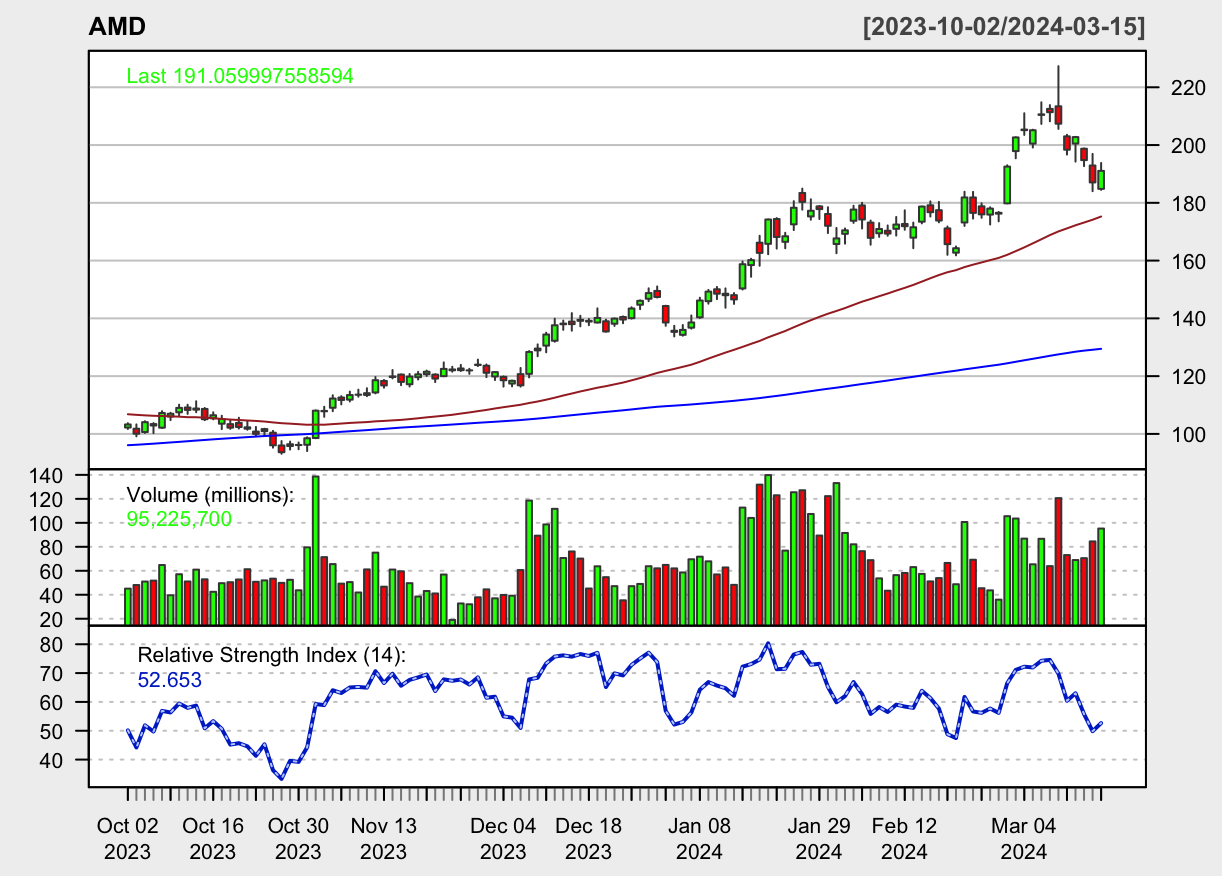

Stock Market MSFT Gold Silver NVDA AMD Numismatic Coin CollectorsMarkets had an interesting week, especially if you were trading the #AI stocks like NVDA and AMD. Both of those darlings sold off. NVDA looks to be firming up but it’s too early to tell. AMD is heading lower and I expect it to test the $180 level. I’d become a buyer around there.

After transferring my brokerage account over to Interactive Brokers (referral link), I put on a single #options trade. I sold my first put to collect premium and bought a long dated put for insurance on MSFT. This is called a diagonal spread trade and I’m banking that MSFT will climb higher here.

MSFT will benefit greatly from the #GenAI innovation because they’ll put all that stuff in MS Office. The chipmakers will benefit too from all the demand, so right now everything is AI. Focus on that and you’ll do fine, hopefully.

Gold and Silver Prices

My gold and silver price forecast model missed its forecast by a lot. Both metals swung for the fences and higher than forecast.

My gold model was forecasting that gold prices would close at $2,023.30, but it didn’t. Instead, the gold price forecast model had a high target of $2,116.48 which gold did swing to. So this means there is a lot of volatility in gold right now. What this bodes I don’t know yet.

The silver price model forecast that silver would close at $22.61, instead it closed over $25 per ounce. While the forecast was off, it did forecast a swing high target of $25.90 and silver did approach that price level. Just like gold, there’s a lot of volatility in silver right now.

Coin collectors, Numismatics, and Stackers will be paying premiums now as the volatility continues.

Next Trading Week

I might buy some AMD call options next week depending on what AMD does. I’ll continue to monitor my MSFT short put and plan to let it expire if MSFT is trending higher or close out on Thursday if the market moves against me. Then I’ll sell another MSFT put option next Thursday or Friday when I close out the position.

This is the experiment and I’m only “playing” with one contract with only $500 at risk. If this goes well then I’ll continue with larger contract sizes and losing the spread a bit.

Disclosure: Long Gold and Silver coins, MSFT options, and a bunch of long-term holdings.