After revisiting an old post about seasonal trading and investing strategies, I decided to start looking at how to rebase time series in Python. It’s pretty simple considering I cheated and looked at Stack Exchange.

The Python code is simply this:

#!/usr/bin/env python

# coding: utf-8

# In[46]:

#https://stackoverflow.com/questions/36153944/pandas-creating-an-indexed-time-series-starting-from-100-from-returns-data

import pandas as pd

import numpy as np

import yfinance as yf

import matplotlib.pyplot as plt

import datetime as dt

# In[47]:

tickers =['SPY', 'EWM', 'EWJ', 'FXI']

# In[48]:

start=dt.datetime(2007,5,1)

end= dt.datetime.now()

# In[49]:

assets=yf.download(tickers,start,end)['Adj Close']

# In[50]:

assets_indexrow=assets[:1]

# In[51]:

for ticker in tickers:

assets[ticker+'_indexed']=(assets[ticker]/ assets_indexrow[ticker][0])*100

# In[52]:

assets.drop(columns =tickers, inplace=True)

# In[53]:

plt.figure(figsize=(14, 7))

for c in assets.columns.values:

plt.plot(assets.index, assets[c], lw=3, alpha=0.8,label=c)

plt.legend(loc='upper left', fontsize=12)

plt.ylabel('Value Change')

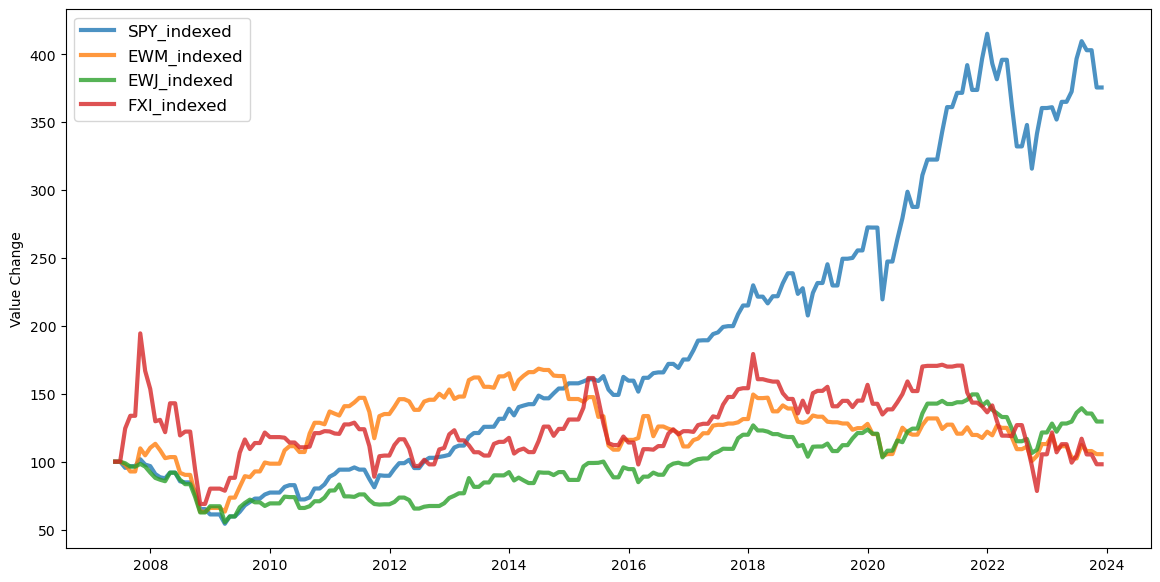

When you run it, it generates this neat graph that shows the SPY ETF out performing FXI, EWM, and EWJ from May 2007, the time when this “blog” / publication started.

I then decided to resample the time series using the following snippet of code:

assets = assets.resample('1M').asfreq().ffill()

Then I regenerated the graph for monthly a monthly basis and got this.

Overall, it’s a simple thing to do in Python and I’ll stick with this over the R Code, even though the R libraries have some nicer plotting abilities. The next trick is to convert the time stamps into monthly numbers and recreate what Eric did with his R Code in Python.

That should be easy, all I need to do is add these lines of code to the assets dataframe:

assets['year'] = assets.index.year

assets['month'] = assets.index.month

Done!