Real Estate iShares IYR

Investing Real Estate Investing Trading Stock Market Trends StocktwitsCould the trend party in IYR be over? Maybe.

A lot of information can be gleaned from observing a price chart, mostly technical information. A lot of traders/investors forget that fundamental and sentiment information also drives prices up or down.

Learn Stock Trading, Investing, and Risk Management

There are a handful of financial and trading books that have made a HUGE impact on my investments. If you want to trade and learn about money and risk management then I suggest you get the Van Tharp book. If you want just focus on long term investing, get the Random Walk Down Wall Street book.

Hell, get them both. I owe my wealth to what I learned in those books.

Update

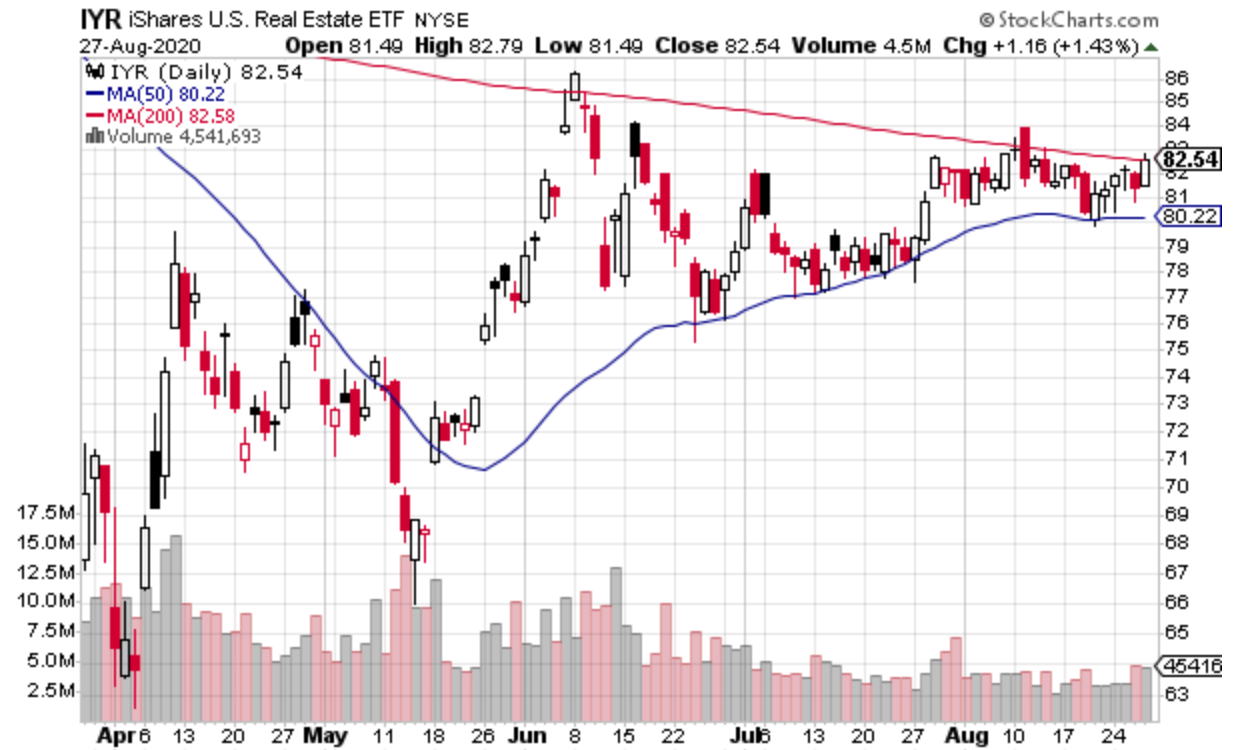

I wrote an update back on 2019 and review how well IYR did all these years. Now that it’s 2020 and COVID19 hit, the market in the summer is ON FIRE! There’s been so much market variance and shennaigans since I first posted about in 2007. We’ve had super low interest rates that fueled the market crash in 2007 / 2008, then we still had historically low rates through the Obama years, only to have Trump scare the Federal Reserve into submission and make rates even lower.

We took advantage of those rates to refinance again, this time down the lowest we’ve ever had: 2.25%. The mortgage company said they’ve been dealing with unprecedendted demand. On top of that, my realtor friends say that houses have been selling like crazy. There are bidding wars and many New York City people are moving out to the suburbs. Why? Because of COVID19. My guess is that people don’t want to be a city when there’s a pandemic. At least in the suburbs they ccan walk around in their yards or the street without fear of bumping into some one. It makes a ton of sense to me.

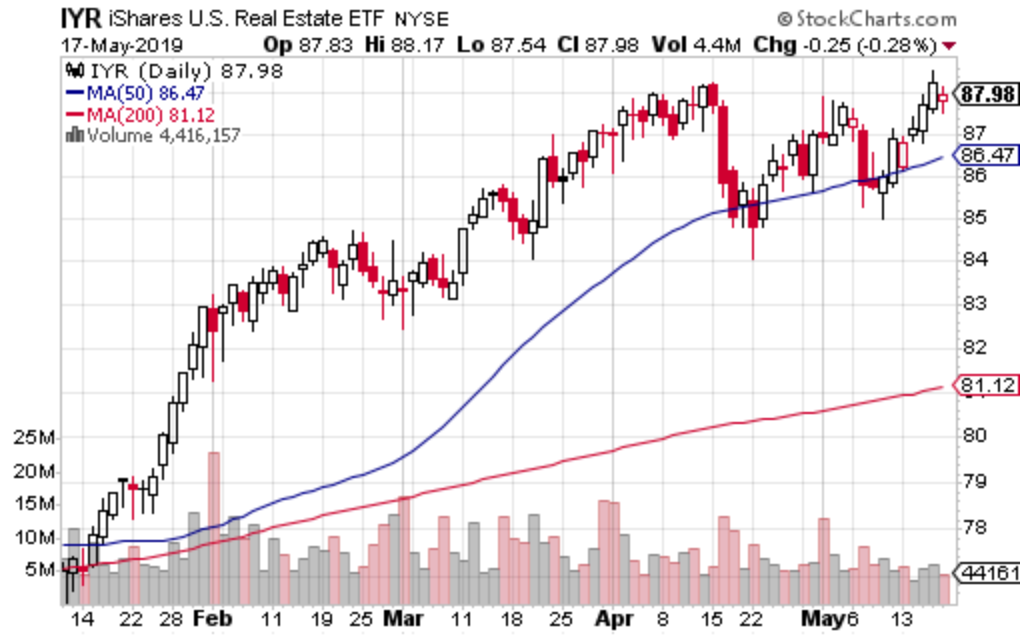

Here’s what IYR was doing in 2019 when I made my first update. It was trading around $87 a share. It didn’t go ANYWHERE really in the past 12 years.

13 years later, it’s actually lower. Here’s IYR today (August 28, 2020) trading around $84 a share. It’s still recovering from the COVID19 selloff.

End Notes

While I like real estate in general, I’m wondering if we’re going to go into a long period of sideways action. People are fleeing the cities right now and prices will come down in the city. On top of that, working environments are going to change to deal with post-COVID19. There will be more people going virtual and I think the demand for office space will drop for a while. It might be a good idea to buy a condo now, somewhere near the City, like Hoboken.